Fozzie’s namesake

Hello again.

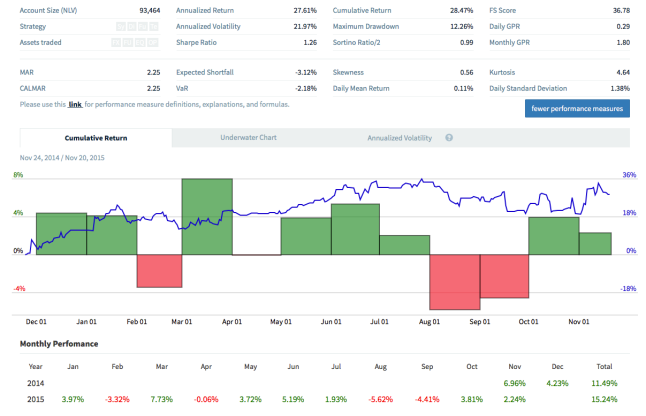

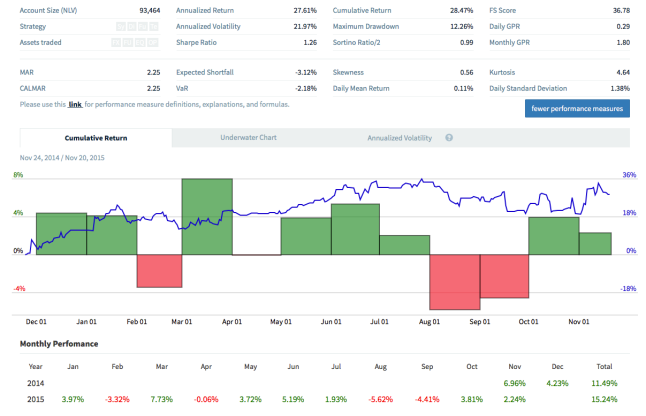

As many know, I left the corporate/hedge fund world to trade for myself. Until renewable energy took most of my waking hours, anyway. But while I have been away, doing my best to help build waste-to-energy power plants, my trading system has been quietly ‘waka-waka’ -ing in the background. And so, one year after switching on Fozzie, here is the result (thanks to Fundseeder for the free admin/tracking tool):

The Foz, one year on from live trading (source: Fundseeder)

Some characteristics and thoughts regarding Fozzie:

- Momentum still works. At its core, this is a momentum system. How can you tell from the above? Winning months tend to be larger than losing months (in size), which gets reflected in the positive skewness in the statistics. The Sharpe is in line with a momentum system. And the system has already been through a pretty sustained drawdown period.

- Diversification works. Though not obvious from the above, the system’s gains were spread across just about all assets traded (which is an admittedly small pool of 12 futures contracts). But there were contributions from FX, bonds, equities, and commodities.

- Amibroker works. I mentioned before that I’m too lazy and not skilled enough to code and take ownership of my code for production trading. My solution has been Amibroker, which works very well for my purposes.

Finally, acknowledgements:

- Tech: my wife, who allowed me to purchase a new MacPro for the system. Ultimately, it was way over spec’d. But who would’ve known? Also to Amibroker for a great program, and Fundseeder for the above.

- Interactive Brokers: low cost; API. ‘Nuff said.

- Mentors: Rob Carver and Thomas Smith.

- My new job. for keeping my Foz interventions to a minimum.

So: what’s next for Foz? Probably scaling up, and probably moving the system to the cloud. I may re-examine exit logic as well, using some Bayesian shenanigans from the existing and ongoing trade records.